COMMERCIAL CREDIT OS

Your Brand, Your Credit Program

Seamlessly embed financing into your platform to improve monetization.

Launch in days, not months

Precise provides a fully managed Commercial Credit OS, equipping brands with cutting-edge underwriting, risk management, and embedded finance capabilities—with or without direct capital exposure.

Effortless Onboarding

Set up your commercial credit operation with a guided process that handles legal, compliance, and funding logistics.

Instant Infrastructure

No need to build from scratch—Precise provides everything from deal sourcing, to monitoring to collections, ready to go.

Full Control, Minimal Effort

Define your parameters, fund your portfolio, and start deploying capital—all within days, not months.

Scalable from Day One

Whether starting small or launching at scale, Precise adapts to your needs and strategic choices.

POWERED BY AI

Robust Capabilities,

Minimal Overhead.

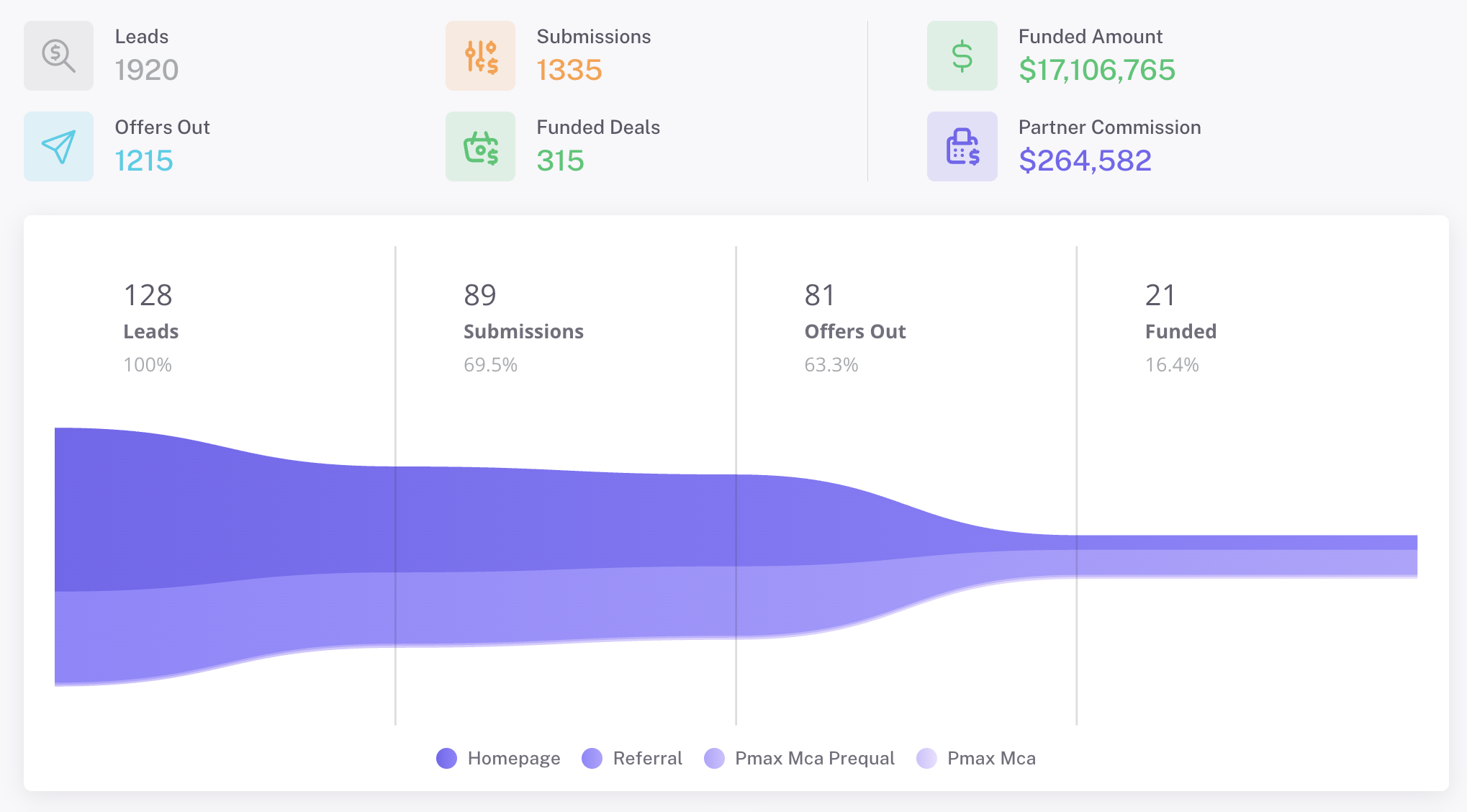

Precise automates the labor-intensive aspects of running a commercial credit portfolio—handling sourcing, underwriting, monitoring, reporting, deployment, collection and recovery, for optimal returns without the traditional operational overhead.

"Precise has given me access to a fast growing, huge market that has thus far been inaccessible to me. "

Jacob Jones, CEO @ Penta

Enterprise Grade Infrastructure

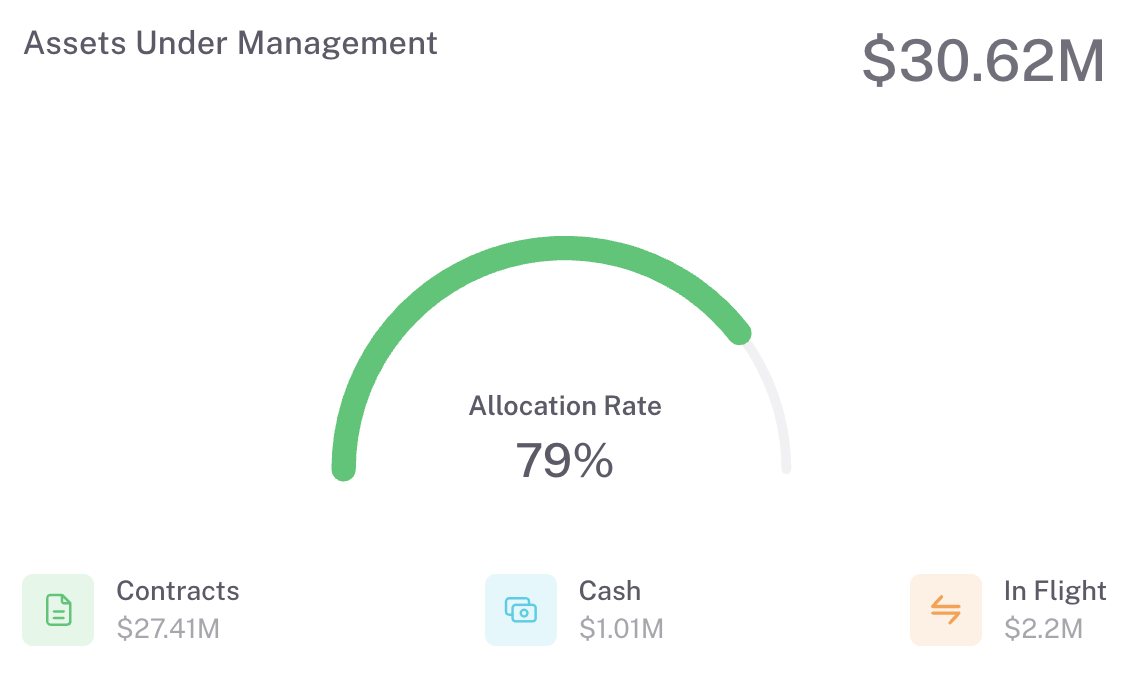

Our infrastructure is built to handle the demands of commercial credit at scale—from reliability in processing high-transaction volume, to complex underwriting execution, and managing real-time risk, to the filing and tracking of every lead contract and interaction.

Designed for Scale

Seamless processing of transactions, underwriting, and collections—without delays or bottlenecks.

Real-Time Risk Detection

Evaluate real time financial data to detect risks early, alert and offer a course of action.

Enterprise Grade Security

All data, transactions, and information is secured using enterprise grade encryption and infrastructure.

Meticulous Compliance

Every lead, contract and interaction is logged and filed to perfection above and beyond industry standards.

From INSIGHT TO ACTION

Automating Credit

Integrating business performance monitoring with proactive automated collection protocols enables early risk identification and swift mitigation, effectively reducing PD (Probability of Default) and lowering LGD (Loss Given Default).

Comprehensive Data Coverage

Doing More,

With More

Utilizing an extensive range of data obtained through APIs and data sets, Precise enables the underwriting (risk scoring), capital deployment, and collection orchestration by leveraging real-time information and in-depth insights for enhanced accuracy and efficiency, automating otherwise labor intensive workflows.

YOUR BRAND OUR INFRASTRUCTURE

White-Labeled, Fully Customizable

Operate a commercial credit portfolio under your own brand. From onboarding to reporting, every touchpoint is customizable—ensuring a seamless experience for your stakeholders while maintaining full control over your portfolio and communications.