PRECISE FINANCE

Working Thesis

Seamlessly embed financing into your platform to improve monetization.

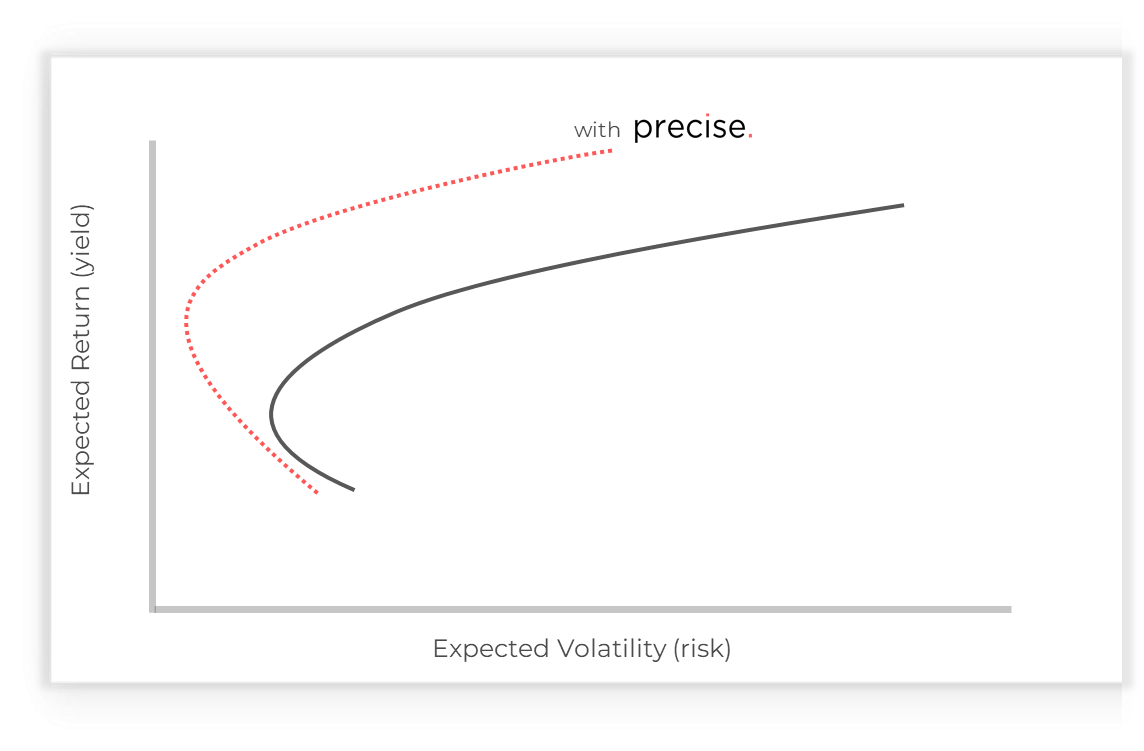

Challenging the Efficient Frontier.

Machine Mastery of Labor-Intensive Roles and its Implications on Risk-Adjusted Returns

TECH IMPACTING FINANCE

Machine Learning

in Finance.

The modern financial landscape is evolving at a rapid pace, with new technological capabilities such as machine learning and autonomous decision making playing an increasingly crucial role in shaping the future of business and finance.

Leveraging these new technological advancements, Precise is able to challenge traditional norms and unlock new opportunities that were previously untapped; disrupting the commercial credit space, transforming labor-intensive roles and eventually challenging the efficient frontier for risk-adjusted returns.

RISK VS REWARD

Going Down Market

For wealth managers and investors, the pursuit of high yields in investment portfolios is an ongoing challenge.

Traditionally, high operating costs pushed investors “up-market” where the competition is most intense and yields are much lower, but recently some investors are turning their attention “down-market” where smaller, less stable businesses have an unmet need for financing and willingness to pay higher price-tags for a shorter duration.

The issue with going “down-market” and dealing with smaller businesses with less-than-stellar credit profiles, is typically characterized by higher perceived risk and elevated operational costs associated with debt recovery, ongoing collection, and underwriting.

ANALYZING

Automation vs Risk

With the advent of new technological capabilities, investors are beginning to recognize the untapped potential of going “down-market” despite perceived risk.

By employing advanced risk management techniques and leveraging the power of machine learning, wealth managers, investors and financial institutions can now more accurately assess the true risk of providing capital to this underserved market and unlock new opportunities for yield generation, optimize their investment portfolios, and in turn, enjoy the redefinition of the efficient frontier.

One of the key drivers behind this shift in focus “down-market” is the growing trend of automation in credit management.

Leveraging these new technological advancements, Precise is able to challenge traditional norms and unlock new opportunities that were previously untapped; disrupting the commercial credit space, transforming labor-intensive roles and eventually challenging the efficient frontier for risk-adjusted returns.

Traditionally, the process of underwriting, servicing, and collecting on financing has been a labor-intensive and costly endeavor, particularly when dealing with higher-risk target companies.

Through the use of artificial intelligence (AI) and machine learning algorithms, investors using Precise can now more effectively mitigate the inherent risks while maintaining a lower cost structure by automating the credit management.

As a result, the risk- adjusted returns from “down-market” investments becomes much more attractive.

UNDERSTANDING

Loss Given Default vs. Probability of Default

When proving an ECL (Expected Credit Loss) model, two of the key metrics to have traditionally been used for risk assessment are:

Probability of Default (PD) – the likelihood that a business will default on their financing Loss Given Default (LGD) – the amount of loss likely to incur in the event of a default.

Historically, the emphasis has been placed on minimizing PD, as investors chose to focus their effort to identify and avoid high-risk deals rather than try exercising on assurances and incur the high costs and low rates of success involved.

With the advent of new technological capabilities, the focus is shifting towards a more comprehensive understanding of risk, with LGD emerging as an equally, if not more, important metric. This is because the true cost of a default is not solely determined by the likelihood of it occurring, but also by the severity.

Precise's mission & advantage.

Connecting the Dots.

Precise’s mission is to improve the commercial credit ecosystem by focusing on the challenges faced by wealth managers, investors and financial institutions looking to invest in smaller businesses that are normally considered of higher risk.

In practice, our way of delivering long-term value for our clients involves:

Enhanced Underwriting Capabilities

Leveraging advanced analytics, machine learning, and AI, we develop predictive models that provide more accurate and comprehensive risk assessments. This enables our clients to make better-informed decisions when investing down-market, while mitigating the risks associated with higher operational costs and bad debt recovery.

Seamless Collections and Debt Recovery

We offer end-to-end collection solutions that automate and optimize the recovery process. Our platform empowers financial institutions to manage delinquent accounts more effectively, reducing the operational costs associated with collections while improving the success rate of debt recovery.

Comprehensive Investment Monitoring

Our platform provides real-time monitoring of investments, giving clients a clear and actionable view of their portfolio performance. This allows investors to proactively manage risks, optimize returns, and identify potential opportunities for growth.

Scalable & Customizable Software Services

Precise offers a range of software services tailored to meet the unique needs of different types of investors. Our flexible solutions can be easily integrated into existing systems, ensuring seamless adoption and long-term value.

Empowering Smaller Businesses

By enabling investors to invest ”down-market”, we help bridge the financing gap faced by small and medium-sized businesses fostering economic growth and job creation.